Back to: Unlocking Gold: Establishing Your Precious Metals Refinery in South Africa

- Overview of relevant South African legislation governing precious metals

- Identifying the necessary licenses and permits for establishing and operating a gold refinery.

- The application process for refining licenses and environmental permits.

- Engaging with relevant government agencies

- Compliance requirements and ongoing reporting obligations.

Act No. 37 of 2005: Precious Metals Act, 2005 South Africa

The Precious Metals Act, 2005 (Act No. 37 of 2005) is essential legislation governing the acquisition, possession, processing, and disposal of precious metals in South Africa. Understanding its provisions is crucial for obtaining and maintaining a licence to operate in this industry.

This Act applies to various precious metals, including gold, platinum group metals, their ores, and any additional metals designated by the Minister. It outlines regulations for:

- Obtaining Licences and Permits: Different licences are required for activities like refining, beneficiation (value addition), and jewellery making.

- Record Keeping: Maintaining accurate records of precious metal transactions is mandatory.

- Inspections: The South African Police Service and authorized officials have the authority to inspect premises and seize unlicensed materials.

- Offences and Penalties: Violations of the Act can result in penalties and confiscation of precious metals.

Familiarization is Key

A thorough understanding of the Precious Metals Act is vital for your licence application process. Inspectors may ask you questions to assess your knowledge of the Act’s requirements. We highly recommend reviewing the Act in detail to ensure you are well-prepared for any enquiries during the inspection.

Resources

For your reference, you can access the full text of the Precious Metals Act below for download

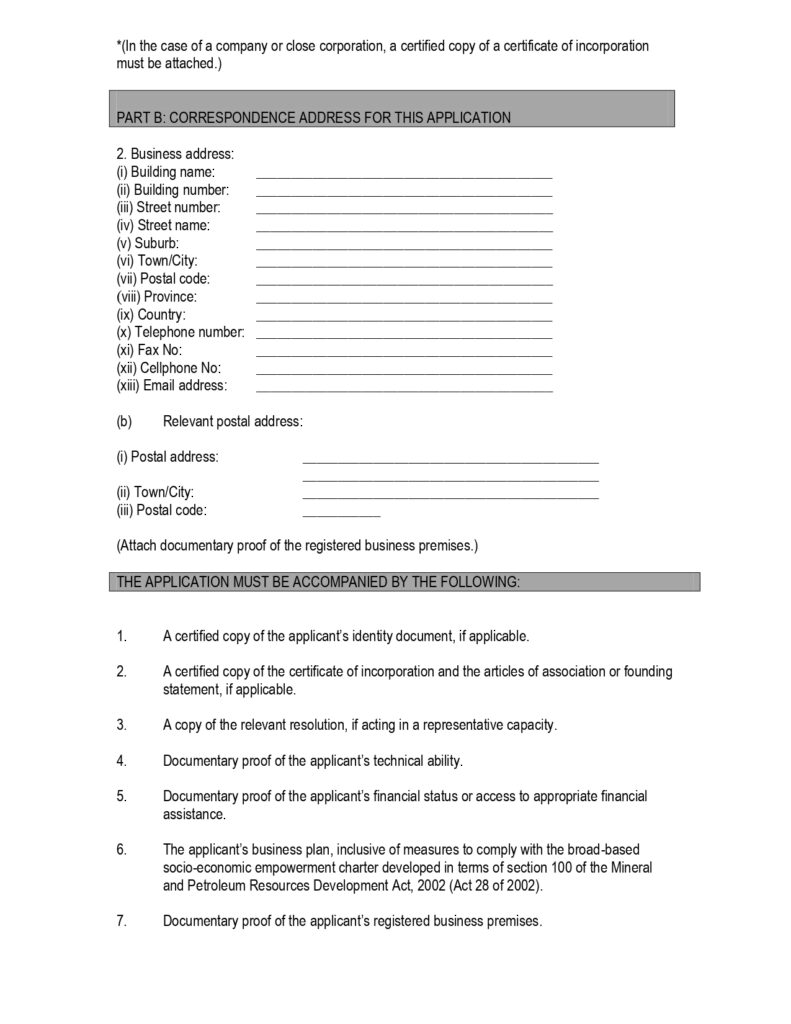

Refining Licence Application Checklist:

Required Documents (✓ to Tick):

- [ ] Duly Completed Application Form (PMR) Download Below

- [ ] Application Fee (R20 000.00) Payable once the application is accepted by SADPMR, they will send an invoice requesting payment, it must be paid within 24 hours or the application or it will need to be resubmitted.

- [ ] Proof of Business Premises (lease agreement, ownership documents)

- [ ] Inspection Report (from authorised official)

- [ ] Statement of Account / Proof of bank Account (from reputable bank)

- [ ] Transformation Verification Report (if applicable)

- [ ] Proposed Business Plan (including Broad-Based Socio-Economic Empowerment (BBBEE) plan)

- [ ] Company Registration Forms (e.g., Certificate of Incorporation)

- [ ] Copy of Resolution (if acting in a representative capacity)

Additional Supporting Documents (✓ to Tick):

- [ ] Police Clearance Certificates (for all directors/owners)

- [ ] Copy of I.D Document (for all directors/owners)

- [ ] Tax Clearance Certificate (company)

- [ ] Proof of Technical Ability (Metallurgist or Chemical Engineer)

- [ ] Proof of Adequate Financial Ability (business plans, financial projections)

- [ ] Documentary proof of compliance with the National Environmental Management Act, 1998 (Act 107 of 1998) (NEMA)

- [ ] Consultation with SARB/National Treasury (if applicable)

- [ ] Proof of Local Demand (market research, offtake agreements)

- [ ] Contracts/Letters of Intent (with suppliers/buyers)

- [ ] Activity Report (if applicable)

- [ ] Evaluation Report (if applicable)

Application for Refining Licence Form PMR Download

The South African precious metals industry plays a significant role in the country’s economy. Obtaining a Refining Licence, as mandated by Section 7(1) of the Precious Metals Act, 2005 (Act No. 37 of 2005), is a critical first step for businesses aiming to refine precious metals, Import or export precious metals.

The Precious Metals Act establishes a legal framework for the acquisition, processing, and disposal of precious metals in South Africa. A Refining Licence authorizes the holder to transform raw precious metals or scrap materials into refined products of high purity. These products can take various forms, including ingots, granules, or sheets, depending on the intended use.

Compliance with NEMA for a Refinery Licence

The National Environmental Management Act (NEMA) plays a crucial role in regulating the environmental impact of industrial activities like precious metal refining. When applying for a Refining Licence, you will be required to submit documents demonstrating compliance with NEMA. These documents might include:

- Environmental Impact Assessment (EIA) Report: Depending on the size and potential environmental impact of your proposed refining operation, an EIA report may be necessary. This report assesses the potential environmental effects of your activities and outlines mitigation measures to minimize any negative impacts.

- Environmental Authorisation: Based on the EIA report, the relevant environmental authority may issue an environmental authorisation that outlines specific conditions you must adhere to during operation. This authorisation could specify waste management practices, emission control procedures, or monitoring requirements.

- Waste Management Plan: A comprehensive plan detailing how you will handle and dispose of hazardous waste generated during the refining process may be required.

Need Assistance?

We can streamline the application process for your licence by assisting with the application itself and compiling all the necessary documents for submission to the regulator on your behalf. Additionally, I’ll handle direct follow-up regarding the application, keeping you informed throughout the process. My service ensures your licence is finalised within 8 weeks after submitting with all supporting documents.

Consultation Fee: R50,000.00 WhatsApp Evan +27739990999 CLICK HERE

Payment Terms:

- A 50% deposit is required upfront to commence with application

- The remaining balance will be due upon acceptance of the application and issuance of an invoice by the regulator.

Registers Form PMR 4 Compliance requirements and ongoing reporting obligations

GUIDELINES FOR COMPLETING AND SUBMITTING PMR 4

General Instructions to Complete Register

These instructions and guidelines relate to the completion and submission of prescribed forms by holders of Refinery Licence

- Forms must be completed in the relevant prescribed form, which are obtainable as follows:

- online at the South African Diamond & Precious Metals Regulator’s (SADPMR or Regulator for short) website: www.sadpmr.co.za;

- can be sent by e-mail or post, by contacting SADPMR (Regulator) by phone at

011 334-9001; or - available at the premises of SADPMR: Corner 38 Bonaero Drive & Cote D’Azur avenue OR Tambo SEZ (GIDZ, Bonaero Park, Kempton Park, 1622, South Africa

- Copies of completed and signed forms must be delivered or scanned in pdf format and e-mailed registers@sadpmr.co.za :

*If forms are scanned, the signed true copy must also be posted or delivered to SADPMR (Regulator for short). The original must be kept by the licensee/holder as required by the Precious Metals Act, 2005 or the Regulations under this Act.

- Complete the relevant form/s in block letters and in black.

- All information or data submitted on the forms must be clearly legible; otherwise the form/s would be regarded as incomplete.

- It is advisable to print out forms in A3 size in order to fit in all the information required when completing.

- Complete the form/s in English only

- Submit the form on or before the date specified on the form.

- If applicable, please indicate which data is to be treated as confidential.

- Please note that the Regulator may amend the form of the registers and other information submission forms as it may deem fit from time to time. Please ensure you have the most recent update of the form/s.

- For any enquiries, contact the Precious Metals Division of the Regulator (SADPMR) during office hours.

Information Submission Form Completion Guidelines

Complete all the required information (read explanation of certain items below), and sign and date the declaration of correctness and completeness on each form submitted.

- For “Financial Year”: fill in month and year of end of financial year in this format February 2008.

- “Name of Permit Holder”: must be as reflected on the permit.

- Fill in current contact details in the spaces provided.

- The Registration number or client code is issued by the Regulator to holders that have been registered with the Regulator. If the registration number has not been obtained as yet, fill in the permit number for this submission and a registration number will be sent to you.

- A jeweller’s permit holder must ─

• Under the column precious metals received/bought, the following information must be entered:

o Month the semi-fabricated precious metal articles were bought

o The name, address and license, permit or registration number of the seller

o The nature of the precious metal which is the form of the precious metal bought (e.g. 18ct white gold)

o The total mass/weight of the product type bought in the month

• Under the column articles manufactured, the following information:

o List the number and type of articles manufactured in the month (e.g. 7, 18ct gold rings; 2, Pt950 chains etc.)

• Under the column precious metals disposed of/sold, the following information must be entered:

o Month the semi-fabricated precious metal articles were disposed of/ sold

o The name, address and license, permit or registration number of the buyer

o The form and total mass of the semi-fabricated precious metal article that is disposed of/sold (e.g. 10 g of gold and platinum scrap)

o The fine mass/composition of the precious metal(s) in the semi-fabricated precious metal article(s) that is/are disposed/sold. This information will be obtained from the refiner to whom the articles are disposed.

• Next to the cell “Number of employees”: state the average number of employees employed over the quarter in the space provided;

- For all paper transactions such as in cases where a company buys precious metals but the metals are delivered to a third party by the seller, then when recording these transactions the buyer should indicate that it the transaction is a paper transaction by including the superscript Pa in the cell under the price column.

- In the space provided in the bottom-right corner insert the total number of pages of this form submitted.

- A true copy of this information submission form PMR 4 must be submitted to the Regulator no later than 90 days after the end of the financial year of the permit holder’s business.